- cross-posted to:

- aboringdystopia@lemmy.world

- news@lemmy.world

- cross-posted to:

- aboringdystopia@lemmy.world

- news@lemmy.world

We really need to start eating the parasites that talk like this. This fucking shit stain has never worked a day in it’s pathetic little life.

Ramsey was born in Antioch, Tennessee, to real estate developers.[2] He attended Antioch High School where he played ice hockey. At age 18, Ramsey took the real estate exam[2] and began selling property, working through college at The University of Tennessee, Knoxville,[2] where he earned a Bachelor of Science degree in Finance and Real Estate.[3]

Daddy gave him all he’s got and yet it’s my fault my dad was a poor artist and died young?

eat my whole asshole Ramsey

Yeah, that bio screams, “I’ve taken the easiest path available at every step in my life.”

It’s always people born to wealth who feel the most entitlement.

It’s because they are taught about personal property and ownership in a very different way.

Dude went bankrupt in the 80s.

Do you have any recipes for cooking human flesh, since you espouse cannibalism? I’m just wondering if you’re prepared to practice what you preach.

I don’t think you need specific recipes for cooking human flesh, I would think any recipe used for pork would be pretty 1 to 1

What part of that says “got his money from his dad”?

It says he sold property to put himself through school at age 18.

He’s born to real estate developers, probably helps tremendously with connections

Yeah people will hear stories like that and think go-getter, and its like even if it wasn’t a tee ball job, tell an 18 year old off the street to reproduce that outcome with no connections or cash, its not happening.

My dude what 18 year old do you know that owns property?

He was a real estate agent. It doesn’t say he owned property at 18.

You know real estate agents don’t own the properties they sell, right?

However, the upheaval millennials and Gen Z have faced may soon be behind them. The former is expected to become the “richest generation in history,” courtesy of a $90 trillion great wealth transfer in the coming decades, while younger consumers generally say they’re feeling more optimistic about their financial futures.

Don’t worry, eventually your parents will die and you’ll be able to live in the whole house not just the basement.

$90 trillion great wealth transfer. As if that money is going into the hands of people who aren’t already obscenely wealthy to begin with.

Also the the boomers with any wealth are going to live a lot longer. My boomer mom’s mom was 91 when she died, the only reason my mom is solvent is because she inherited and sold grandma’s house.

If my mom lives that long I’ll be in my mid 60s and my brother in his 50s. I’m a late Gen Xer btw.

So the timeline is at least 15-20 more years.

Subscription services will be like “sorry it’s $1k per extra seat now”

This is what neoliberalism and capitalism wants the younger generations to believe, but a large percentage of that wealth will be stolen via health care and similar predatory, exploitative systems.

And do you think the inflation caused solely by greed might be related? They need to capture that money now before it is inherited.

Reverse mortgage enters the chat.

This. My grandparents were well off and set up a trust for me and my brother.

It wasn’t much. And then all of it went into her nursing home when the dementia got so bad we couldn’t care for her ourselves anymore.

And the rich got richer

Yeah, nah.

That wealth isn’t fairly distributed. The children of rich parents will be richer, the rest of us will be worse off.

Whatever isn’t sold off for long term care, which won’t be much.

… $90 trillion great wealth transfer in the coming decades …

This only counts if your deceased parents have any wealth to transfer.

Trickle down economics in a trenchcoat.

Don’t worry, eventually your parents will die and you’ll be able to live in the whole house not just the basement.

Only if you don’t have to sell the house beforehand in order to be able to afford a nursing home for your parents

deleted by creator

deleted by creator

deleted by creator

deleted by creator

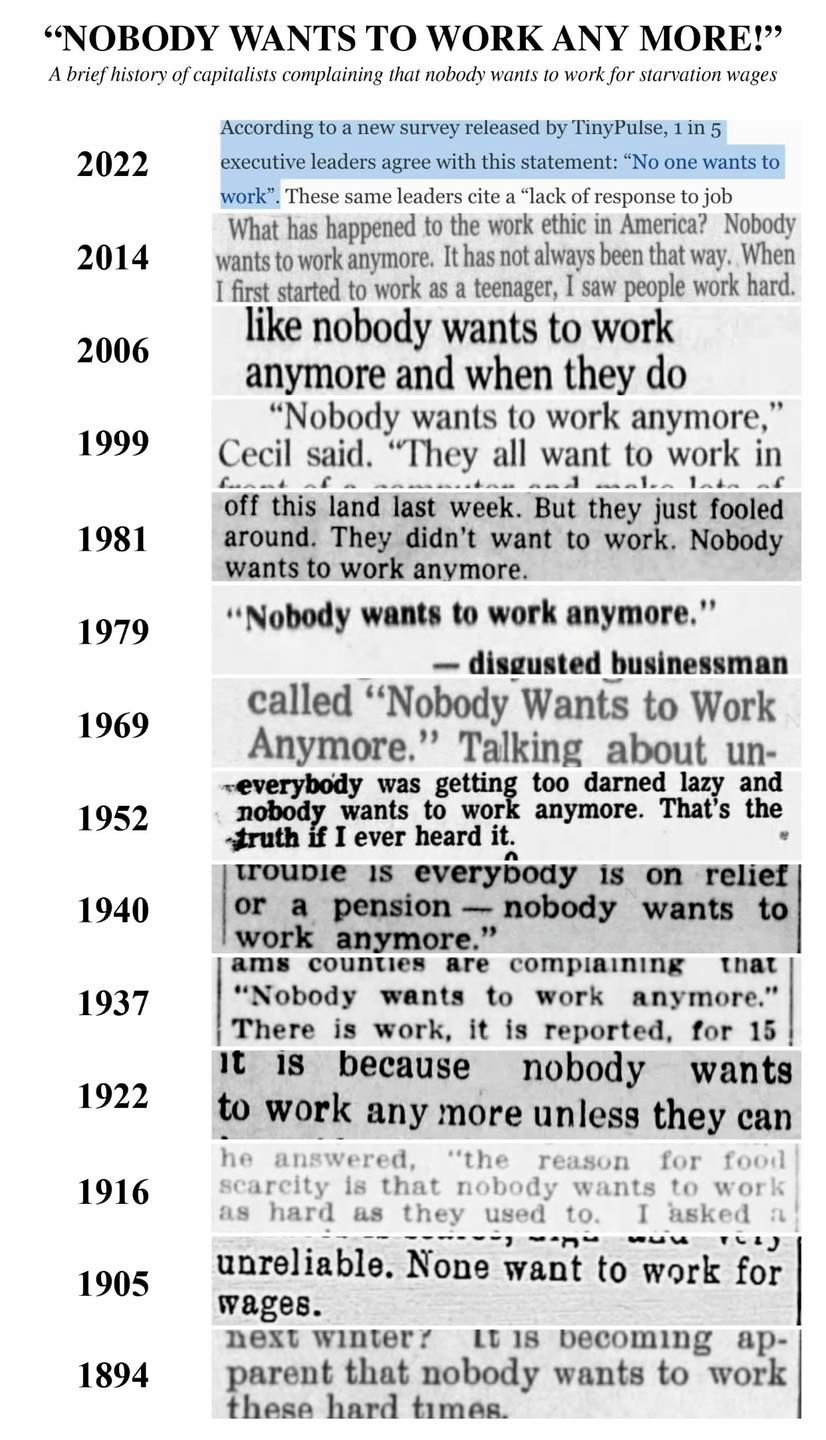

Dave Ramsey sounds like someone who has forgotten what happened last time.

They haven’t forgotten. They bought the cops. Now what do we do?

ACAB.

Pitchforks to dinner forks.

They cannot arrest or kill the entire working class, pitchforks or not. I mean, they could, but then who would work for them and make them richer? They need us and it’s going to be a very painful reminder when we remind them, one way or another.

Slavery is allowed if you’re in prison, so that takes care of the work part.

grasshoppers vs antz

We should have reminded them decades ago. Like in the 90’s when they started shipping jobs overseas for cheaper labor.

Now? Good luck convincing people to bother instead of just doing whatever the mainstream media tells them to do.

This guy was born into a wealthy family and acts like he earned it all

They always do. Its frustrating and disgusting.

Big Trump energy.

Dave Ramsey can fuck himself. This is the same idiot that says you should give 10% of your money as tithe so that an invisible sky daddy doesn’t send you to hell to burn for eternity.

While sitting on a golden throne he made from daddies money telling other’s how to live.

Daddies money? He was literally bankrupt when he had his daughter and rebuilt everything.

Despite being born into money, he managed to take on so much risk that it society had to bail him out. Even so, I’m certain that his net worth after bankruptcy was significantly higher than the vast majority in gen-z.

Defending billionaires online is PATHETIC.

Do you know what bankruptcy does?

It doesn’t mean you have nothing. It’s designed to stop your creditors and protect what you have.

He didn’t start from scratch my dude.

Life experiences can still teach you something even if you don’t start in the same place. If he has good advice it’s good advice at the end of the day.

I’ve been sick of him from the first moment I met an adherent. I mentioned how I like to avoid debt and pay it down early and the person said “Oh, so you listen to Dave Ramsey?” I confessed to having no idea who they were talking about, and they swore that I was being obtuse because I couldn’t have come up with “interest sucks” on my own.

Those who are undereducated often can’t imagine that people can be truly brilliant.

Interest bad is far below brilliant

I guess we could be grading on a curve of people that view Ramsey as brilliant…

George Washington bemoaned debt

No just interest, compound interest is bad

Add in another for trickle down, and the various forms the owner class use to divide us

Thanks, I was gonna post this if someone hadn’t.

We should teach the millionaires to fear again

I’ve always made good money, and got some good advice when I started my first job to just always put aside 10% for saving, and put that into ira/401k. I’m in my 40s now and a millionaire. I still have to work and will until retirement age.

I know I’m lucky, but you’re really barking up the wrong tree if you think simply having a million dollars makes you bad person. I’m just a saver.

These days, I don’t bat an eye at a seven figure or even low-mid eight figure millionaire. That level of wealth is attainable through individual means (hard work, saving, diligent investing, etc) and probably a significant amount of luck. It’s once you start getting into the mid to upper 8-9 figure and then billionaires where there is no way they achieved that wealth without exploitation and all the other accompanying things these people perpetrate.

Low 8 figures is my in laws. They are both doctors and busted their butts throughout their career. They could have done better had they invested better, but they still have obviously done well for themselves.

Ok then let’s teach the billionaires to fear again.

Too high. How about 100 million?

Done

Or you can start saving and investing when you’re young and be a millionaire when you retire. Compound interest is magic.

Saving what, exactly? The problem is that people arent able to maintain a standard of living, meaning they can’t certainly can’t save.

Or in simpler terms, things are becoming so expensive that they are forced to decrease their standard of living to meet their needs. This isn’t a personal finance issue.

Why don’t you buy 4 houses, you rent 3 and live in one. You can ask your parents for the capital of you don’t have it

^^^/s

Question is, was that standard of living with in their means in the first place, Americans are in 1 trillion of credit card debt. That’s insane to me, we have a spending problem that is now seemingly worse because everything is expensive.

Removed by mod

When you’re already more or less locked in to a lifestyle and then hit with record inflation, not everyone is going to just cancel their lives and live like a pauper, especially families. Yes many people are grossly irresponsible with credit card debt, but that isn’t the story for everyone. You’d have to be living under a rock to not see how insanely expensive life has become in the last few years. Sure people can sell off all of their possessions and move to Nebraska, but that isn’t a reasonable solution.

I hear yah, personally I cancelled a bunch of streaming apps, making all my food and coffee at home and been hitting thrift stores and estate sales for things I need. I know shits expensive, my car is a 2006 and it eats gas but I’m not falling for the new car trap.

People have done all of what you have mentioned here but still living paycheck to paycheck. They did it because they already know they can’t afford stuff. Now they’re starting to stop eating healthy too. You going to claim vegetables are luxury? Fuck you if you do.

Grow micro greens and tomatoes indoors. Lights are cheap af.

Do you know what the majority of debt in this country is? Health care.

Get sick, go broke.

They’re using credit cards to buy essentials like groceries and gas.

We don’t have a spending problem, we have a wage problem. And people like you blaming the poor for the circumstances that people like you put them in is gross

That sounds like we have a Health cost problem. No reason for some meds to cost so much. We also get meds advertised to us, so they spend some money on that instead of lowering prices. Our health system I agree sucks.

No thanks? Why would i be miserable right now and happy long after I’m no longer able to enjoy life? Unless you think we’re on the cusp of curing aging or something.

This is a really cute concept. Many people don’t have an extra $5 a day. Do you know what you get when you invest $5 a day over 12 years at a 4% interest rate? It’s not a million dollars.

About 28000 dollars. Even with a super safe investment that gives you 4%. S&p is like 10% a year. In that case (assuming you lose 1% to the market) you would have 36k.

If you do that over 40 years (25 to 65) you have 640k.

4%?!? where are you getting 4%?? Last time I looked at CD rates it was like 1.2%

You need to look again. I have a 5% standard savings account right now. Fed rates are very high right now.

yeah the rates are way better than last time i looked! gonna have to put some savings into good use.

…what’s the point of becoming a millionaire when I no longer have the same energy as I used to when I could still enjoy things?

Because you’re still going to want to live and do shit when you’re older. And you’ll pay for it in the future with what you do now.

Unless I die tomorrow and never get to use all the money I suffered for now to use later.

Don’t get me wrong, it’s a balancing act. But there’s no promise I’ll even make it to retirement. So I’m going to enjoy my now, just in case.

I thought like that in my 20s.

- What was your first job and how old were you?

- Who paid for your education and how?

- What was your lowest salary?

- Construction at 14 for a summer.

- My parents who moved here in the 60s with practically nothing and worked their asses off in factories and cleaning houses. I didn’t go to college.

- Minimum wage.

So is compounding health problems. Fuck retirement. Live now. Eat billionaires.

And then not be eligible for government insurance because you have too much money and go bankrupt paying for medication. Plus the million other little cuts and stabs you will take. Your kids had to go to higher ed and if you don’t help them they can’t. Someone tripped on your property and sued you.

What I have learned is this: invest in what can’t be taken away by a financial group or their judicial lackseys. Your skillset, property that has complex financial structure, your tools, your family, your reputation.

Your bank doesn’t want you custom laptop but you with your knowledge have income with it. Your insurance company doesn’t want your house that has crazy agreements about who owns it that would take a generation of lawyers to sort out. Your government doesn’t want your brother-in-law who lives abroad and runs a farm you helped buy. The guy suing you doesn’t want your professional network. What those parasites want is money without effort. So only own the stuff that requires effort to use.

It’s not that they don’t work, it’s that their employers (boomers own the companies) don’t want to pay them

He knows this. I used to listen to his show. And in all my time listening to him, he never took on a caller who was making nine bucks an hour and struggling to make ends meet. His most frequent type of caller is a straight late twenties couple who make $140k a year, who owe maybe $25k in credit cards, and whose obvious answer to fixing the problem is to sell the thousand dollar car payment for something more basic and eat out less often. Because he knows if minimum wage workers get past the screeners, there’s nothing he can do to help. That’s a systemic problem and he knows he’s part of it. What’s he gonna tell them? Go get a better job? Cool. If everyone does that, there won’t be any of those jobs for 90% of them, one, and two, there won’t be anyone working those important low wage jobs. Someone’s gotta flip the burgers. Someone’s gotta stock the shelves. The problem is systemic. And the answer is fuck the rich.

I literally just watched yesterday a 28 year old lady with over 100k in student debt on minimum wage.

It’s not that I’ve been dealt a losing hand, it’s that my generation wasn’t dealt a hand at all, and were cussed out when we asked why the dealer left us out… Then they told us we lost the game because we were too lazy to buy our own cards to use, even though that’s not how Poker works.

What is so bad about living with your parents? That’s still the norm in many parts of the world. For some reason western countries, and especially America, have exaggerated the benefits of being financially independent, as if shared resources were some kind of failure.

I beg to differ. The only people who lose when we share resources are the capitalists.

I’ve got a few friends in their thirties who live with their parents and the whole family is very happy. And although my kids are only six and three, I can’t imagine any reason why I wouldn’t want them to continue living in my house for as long as they needed support.

We all need support. It’s not a shame. It’s an asset more valuable than property, imho.

you might be gay and have to move out, assuming they didn’t throw you out as a teen. even if you’re straight your parent’s won’t respect you as an adult if you live with them and impose restrictions on your lifestyle. you also have to appease them in whatever crazy shit they force on you because they can kuck you out if you refuse

Did that happen to you?

I’m a gen x, and I don’t want to work. I mean really, who does? Who would rather work than spend time with their family and/or see the world? I work because I have to to survive.

People want to work if:

- it is meaningful to them

- their work is a mean to do something meaningful to them.

If you work to survive, there is no prospect to advance or do something fun/meaningful, then why the fuck should people want to work?

And Ramsey is kidding himself, is work is not that hard. So it’s fucking rich coming from someone that peddle his shit to make money.

“want to work”? that’s only for actual humans, you are a parasite leaching off the work of the people who are actually productive, the shareholders, and if they all go hide in a secret valley gated community the world will collapse as they invent a perpetomobile outside the “laws of nature” imposed by the government

(everything up to the perpetomobile is actually held beliefs among these people, just the laws of nature being enforced by the government is a bit of a gag)

I love working! … when I’m self-employed. Knowing that what I’m doing is likely to actually make a difference for someone other than a rich fuck is incredibly motivating.

Finance

gurugrifter Dave RamseyFTFT.

I like to imagine this means “fixed that for thee.”

You aren’t working your way into home ownership in many cases unless you also work your way into a different locality as well.

I bought my small 2x2 condo for around 500k in 2020, it’s now worth ~800k. Housing inflation is out of fucking control.

I’m moving into a house (renting) soon, and the owner bought it 8 years ago for $185,000. It’s now “worth” over $400,000.

The only homes in that price range here are an hour away from where I work.

I know a karate instructor that just bought a 2br 2ba house for 40k, in Tucumcari new mexico

There is affordable housing out there, but you really have to search, and you have to be flexible.

I’m not saying there isn’t a shortage or that prices are inflated. The problem needs fixing.

Very true, if I could work remotely I could easily afford a good size home just a little out of the DFW area.

What if switched jobs, even to a different line of work. DFW, and all of metro Texas is pretty expensive.

I spent most of my career in Houston. We bought a lot of expensive houses and expensive cars. Honestly I never expected to live this long. I really wish I would have stashed money away to live the life I’m living now.

Dave Ramsey is one of those guys where you have to eat the fish but leave the bones.

A lot of what he teaches is really great, practical advice–aimed at people who really might not understand financial basics.

Things like budgeting, saving, investing in mutual funds, and avoiding debt like the plague. That’s all fantastic financial advice. The whole "borrower is servant to the lender stuff pulled right out of the Bible is stuff that most on here would agree with. Debt is a way to force people into financial serfdom.

But occasionally he says stupid shit like this. And maybe it’s taken out of context, but probably not. He always has advocated busting your ass to get out of debt and start saving. He calls it getting “gazelle” intense about it(basically saying banks, lenders, etc are lions trying to kill you). Again, not too far off from whatost people agree with.

So, he’s advocated getting multiple jobs if you need to until you can right your financial ship.

But he’s also an proponent of advocating for yourself and getting better jobs and ditching the second job as soon as you can. So I dunno. He says dumb stuff but he’s also pretty practical overall. Like I said eat the fish, leave the bones.

His “no debt” spiel is a decade out of date. The red queen paradox applies here, most people need to run as fast as they can, just to stay in the same place.

The average house here has gone up in value 55 euros a day for the past decade, and rent has risen faster Unless you’re already doing very well, you cant budget your way into buying a house anymore. Saving 55 euros a day for a decade means you’re standing still, you need to MORE to actually get closer to buying property.

Again, that’s 55 bucks a DAY, or 1650 a month, just keep pace. Dave Ramsey can fuck right off when it takes 32 hours at minimum just to stay as poor as you always were.

No debt has worked for me. I don’t care for him and any of his advice, but getting out of debt has been great for me.

Going by your comments, you’re hardly a struggling gen-z though. When you or I run in place, we’re already miles ahead of those who can barely get off the starting line.

But you were in debt, and the example given of a home mortgage is pretty definitively a debt worth taking on, as rent and increasing housing costs will easily outpace accrued interest.

You should pay that debt down quickly, unless you’re mortgage rate is crazy good and investment returns are crazy high, but that’s not usual. But taking on a mortgage is about the only way you can get into owning a house except for being a trust fund baby.

Some people may have to suck it up and tolerate a car payment, of they can’t afford a 6 to 9 thousands dollar car, because they need transportation to get to work, and any car cheaper than that will be very expensive to repair.

Carrying over any balance on a credit card? Yeah, that’s always a terrible idea.

His no debt spiel is really only get a mortgage once you have no other debt.

The second job thing is interesting, it’s like he doesn’t understand that the economic situation of a society as a whole (generally a country) dictates what % of people can afford to have nice things.

As a result of that, if your society is in a bad economic situation it may very well be the case that even if everybody was working the same number of multiple jobs, advocating for themselves, and busting their butts, most of those people are still going to be in a shitty situation due to things entirely out of their control. Furthermore, the ones that got out of the shitty situation, even though they’re doing all of the same things, only did it due to dumb luck / being in the right place at the right time.